What I did

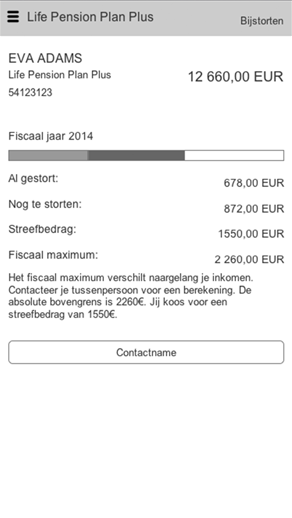

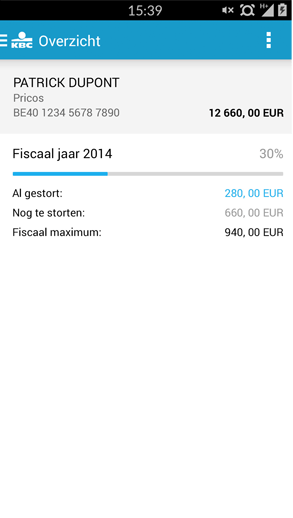

I conducted usability studies to identify user needs and issues, and validate new design proposals.

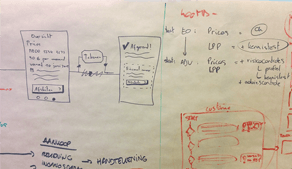

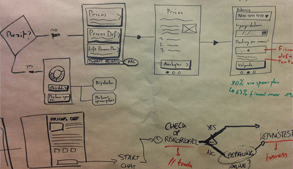

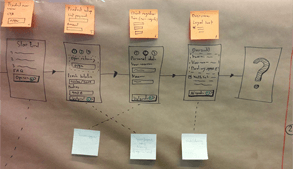

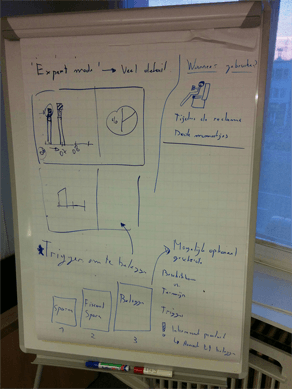

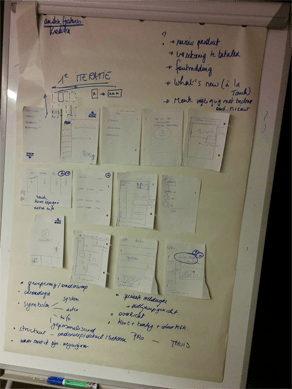

I organised creative sessions with fellow designers to come up with new features and solutions that would cater for the user needs.

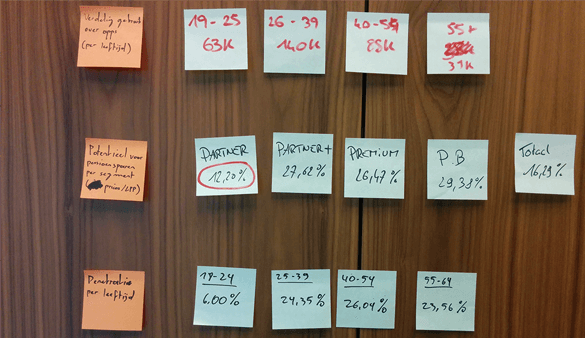

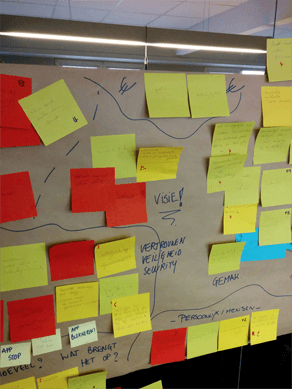

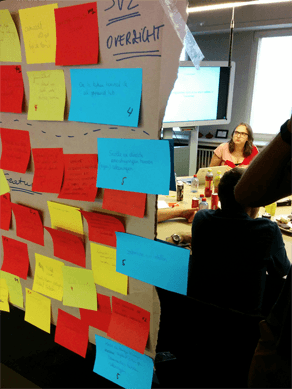

I hosted workshops to conduct the competitors' analysis, bring the data together, and map the business process, and plan further actions.

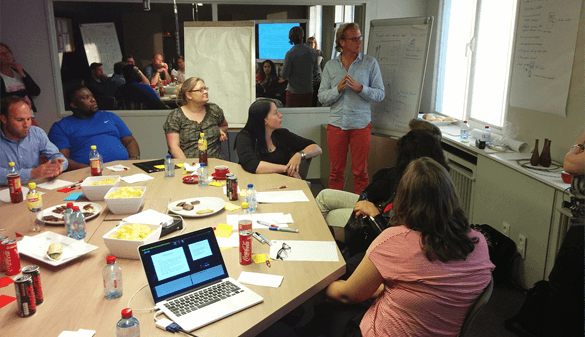

I facilitated a co-creation workshop with 14 participants to identify their user needs, and collaborate with them on solutions.